IOSS: The EU’s new VAT rules and your store

We wanted to share some detail on a new VAT (Value Added Tax) program the EU has implemented, and what we have built to help your business continue running smoothly.

IOSS (Import One-Stop-Shop) is the new VAT collection method rolled out by the EU. This is relevant to anyone who exports goods into the EU, and we hope this overview and the changes we’ve made to the platform help make the change as easy as possible. With specific questions about how these changes may affect your business, we recommend obtaining advice from an accountant or other qualified professional.

What exactly are the changes, and what do they mean for my business?

Previously, there was a €22 de minimis for all orders entering the EU, meaning no VAT was due on any goods worth €22 or less. As of July 1st, 2021, buyers are required to pay VAT on all orders up to €150. Above €150, import VAT and duties will continue to apply.

As a merchant, collecting VAT for your EU-bound orders up to €150 is optional. If you choose not to collect VAT from your customer upon purchase, they will be charged VAT upon delivery. If you wish to collect VAT for your EU-bound orders under €150, you’ll need to obtain an IOSS number and file a monthly return.

If it’s optional, why should I collect VAT from my customers?

You’ll be able to file your VAT returns in a single filing via IOSS. In addition, some shipments may take longer to reach your customer if VAT is not paid in advance of delivery. Valuation checks at customs do occur and can result in delivery delays.

How has netParcel responded to these changes?

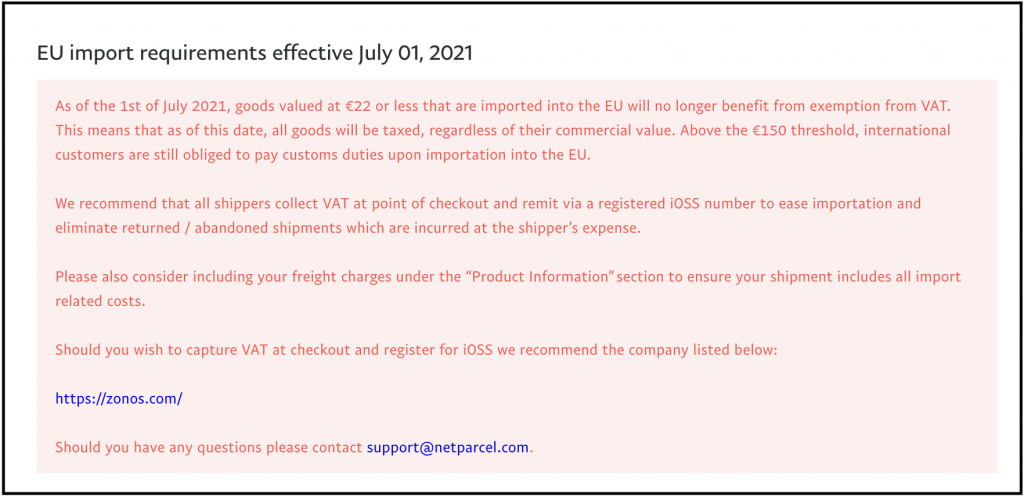

The next time you purchase a shipping label for a shipment to the EU, you’ll notice a few changes to our system. After choosing your desired carrier and service, you will be prompted with this update message:

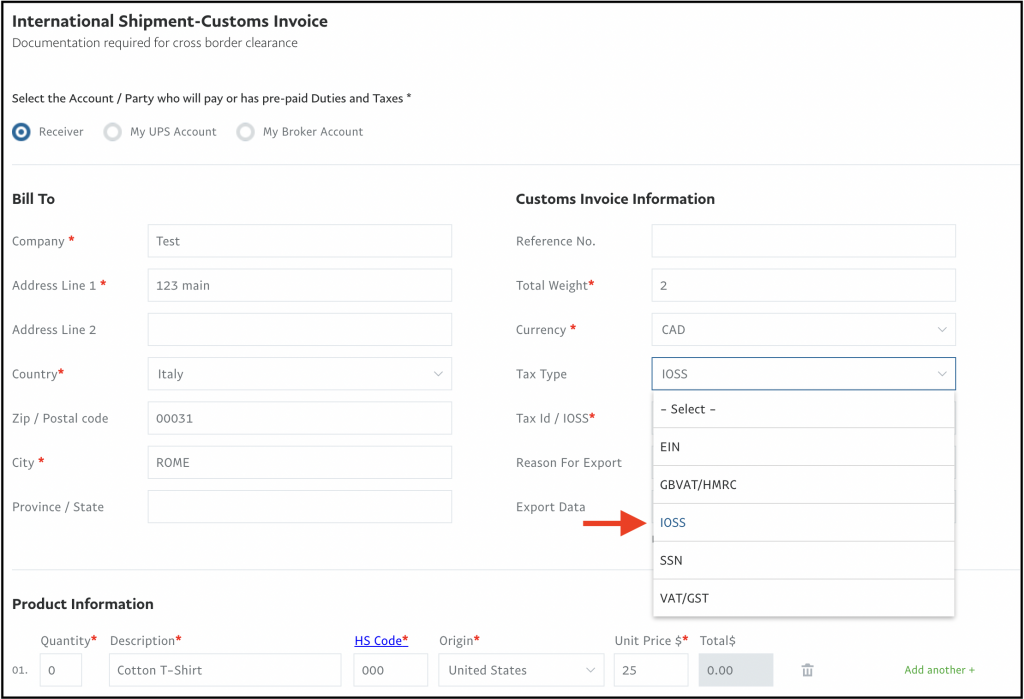

From there, you’ll have the option to select who will pay for duties, taxes, VAT, etc. If your customer has already paid VAT at the point of purchase, please be sure to select “Receiver”:

Just below on the same page, you’ll now notice an option to link your IOSS number:

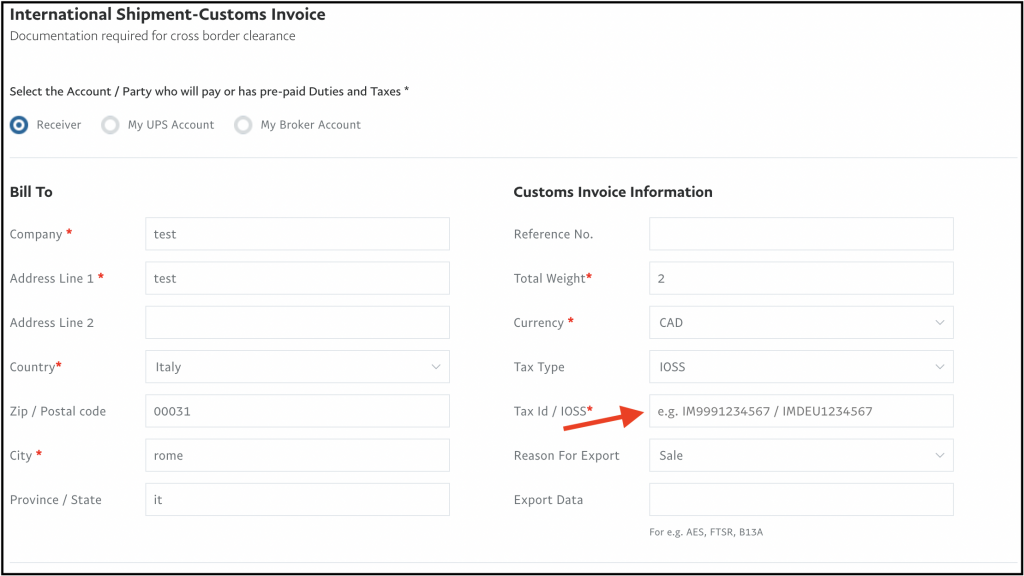

When you choose IOSS from this drop down menu, you’ll simply input your IOSS number in the next field:

Then you’re all set to ship!

What other materials should I review?

- To learn how to capture VAT at checkout and register for IOSS, try: zonos.com

- European Commission: All you need to know about the Import One-Stop Shop (IOSS)

- 2021 Guide: Ecommerce EU VAT reboot (PDF)

- EU 2021 IOSS VAT Intermediary

- OSS or IOSS? EU VAT One-Stop Shop rules for e-commerce

No Comments